by David Schwartz J.D. CPA | Apr 15, 2024 | All, Commentary, Cross-Post

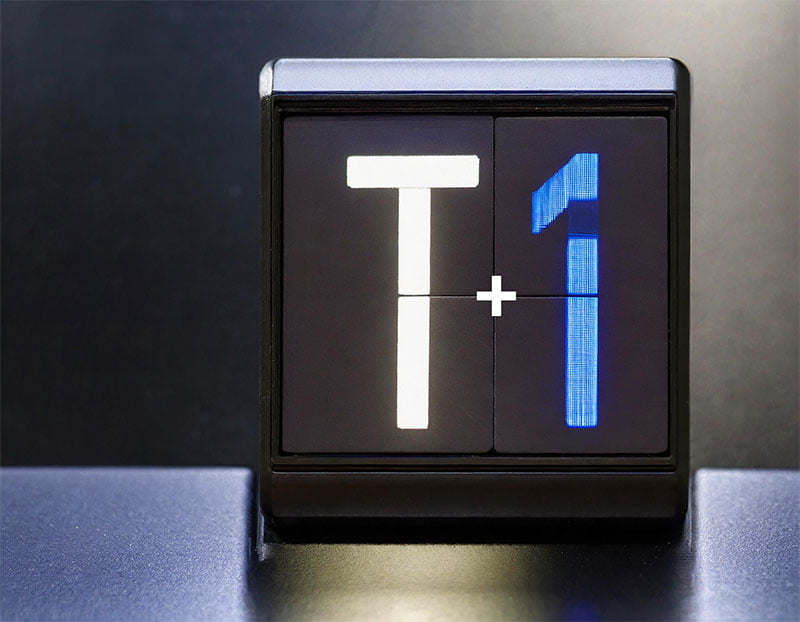

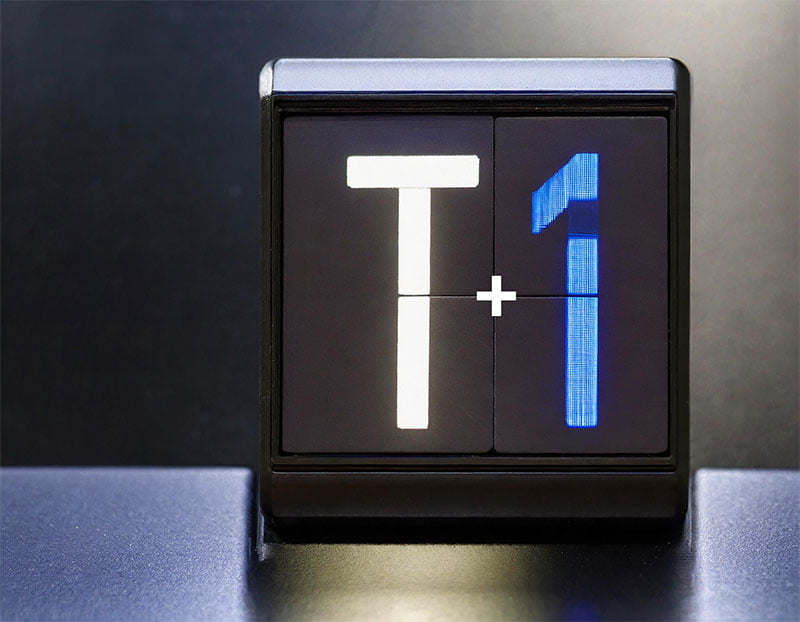

The securities industry is transitioning to a T+1 settlement cycle, where trades settle one business day after the transaction date. While this shift promises benefits like reduced market risk and lower costs, it poses significant challenges for securities lenders....

by David Schwartz J.D. CPA | Oct 24, 2023 | All, Change Overview and Rationale, Cross-Post, Disclosure Regimes, Formal Regulatory Remedies

The Securities and Exchange Commission (SEC) recently adopted final rules on money market (2a-7) fund reforms. These reforms are designed to make money market funds more resilient and liquid, potentially making them safer and more attractive vehicles for mutual funds...

by David Schwartz J.D. CPA | Oct 12, 2023 | All, Change Overview and Rationale, Cross-Post, Disclosure Regimes, Formal Regulatory Remedies

The Securities and Exchange Commission (SEC) has adopted a new rule, rule 10c-1, to increase transparency in the securities lending market. The rule requires certain persons to report information about securities loans to a registered national securities association...

by David Schwartz J.D. CPA | Sep 25, 2023 | All, Change Overview and Rationale, Cross-Post

In March 2021, Archegos Capital Management, a family office run by Bill Hwang, collapsed in a spectacular fashion, leaving its counterparties with over $10 billion in losses. The collapse of Archegos was one of the largest hedge fund failures in history, and it has...

by David Schwartz J.D. CPA | Jul 30, 2023 | All, Change Overview and Rationale, Cross-Post, Disclosure Regimes

In early 2022, the Securities and Exchange Commission (SEC) proposed several significant changes to Regulations 13D and 13G, which require certain persons to disclose their beneficial ownership of equity securities. These changes seek to improve the transparency and...