by Ed Blount, David Schwartz J.D. CPA | May 26, 2025 | All, Cross-Post

The securities lending market is about to enter a radically transformative phase. Starting January 2, 2026, SEC Rule 10c-1a will mandate daily public reporting of all U.S. securities loan transactions via FINRA’s Securities Lending and Transparency Engine (SLATE)....

by Ed Blount | Apr 9, 2025 | All

A large language model is, at root, a spreadsheet for words. Each row is a token; each column, a feature derived from co-occurrence, attention, and statistical context. These numbers do not represent meaning in a classical sense — they encode positional...

by Ed Blount, Dan Hammond | Nov 6, 2023 | All, Change Overview and Rationale, Commentary, Cross-Post, Disclosure Regimes

On April 2nd, 2026, an effusion of data from a daily trove of U.S. regulatory filings will create resources to drive many new use cases for artificial intelligence in capital markets. A clear opportunity exists in securities finance, where practitioners have...

by Ed Blount | Oct 27, 2023 | Commentary, Cross-Post, Disclosure Regimes

Data engineering by Dan Hammond When, on October 13, 2023, the Securities and Exchange Commission released its long-awaited final 10c-1 rule on reporting and public disclosure of securities loans (explained here), the most important passage, at least to the commercial...

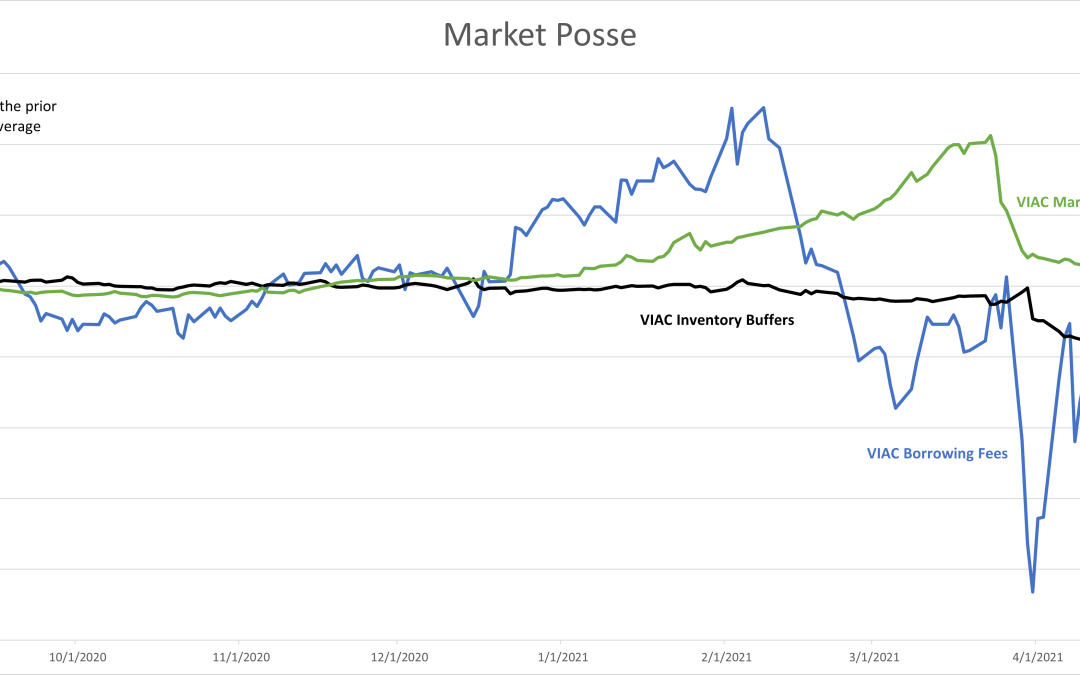

by Ed Blount, Dan Hammond | Sep 27, 2023 | All, Commentary, Cross-Post

By Ed Blount and Dan Hammond “In a matter of days, the companies at the center of Archegos’s trading scheme lost more than $100 billion in market capitalization, Archegos owed billions of dollars more than it had on hand, and Archegos collapsed.”U.S. Federal...