The financial crisis has given rise to record numbers of law suits. But six years on, are we seeing the end of this litigation frenzy? In an effort to answer this question, Fatan Sabry, Eric Wang, and Joseph Mani of NERA Economic Consulting have surveyed existing cases, settlement trends, and new filings looking for trends. In an October 2013 publication, “Credit Crisis Litigation Update: It is Settlement Time,” the three authors take a quantitative look at recent trends in settlement activity, review some major settlements in credit crisis litigation, examine current trends in filings, and discuss mortgage settlements related to repurchase demands by mortgage sellers and Fannie Mae and Freddie Mac. While the study finds that the pace of new filings has slowed, and the size and number of settlements has increased, litigation arising from the financial crisis “far from over,” according to the authors.

In their review of trends in new cases, the authors found that new filings have fallen sharply in 2013.

There have been a total of 927 credit crisis filings from January 2007 through the end of June 2013, but the pace at which new cases are being filed has fallen sharply: only 30 new cases were filed in the first half of 2013, less than half of the 78 cases filed during the first half of 2012.

The authors also see a trend in these new cases arising against a narrower set of defendants than before.

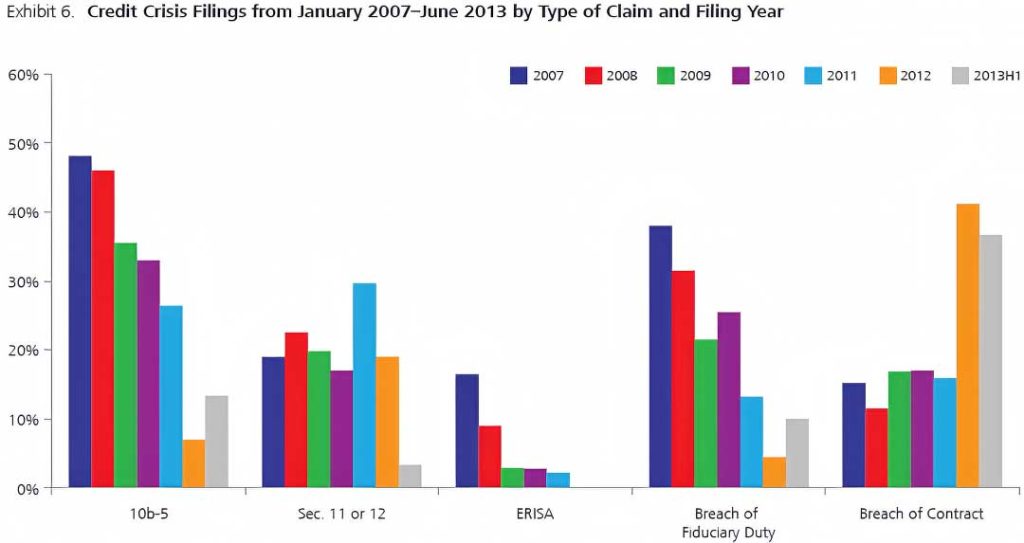

- Consistent with the broad trend, filings of new credit crisis-related cases involving 10b-5 and ERISA allegations have declined markedly since 2007. In contrast, filings of breach of contract cases have increased since 2012.

- In lawsuits filed in 2012 and the first half of 2013, the most commonly named defendants were issuers and underwriters and the allegations were mainly related to structured products such as asset- and mortgage-backed securities (ABS and MBS, respectively).

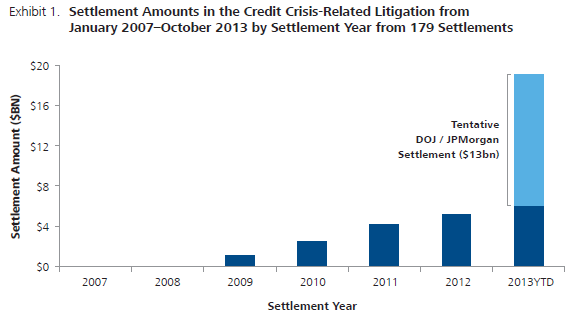

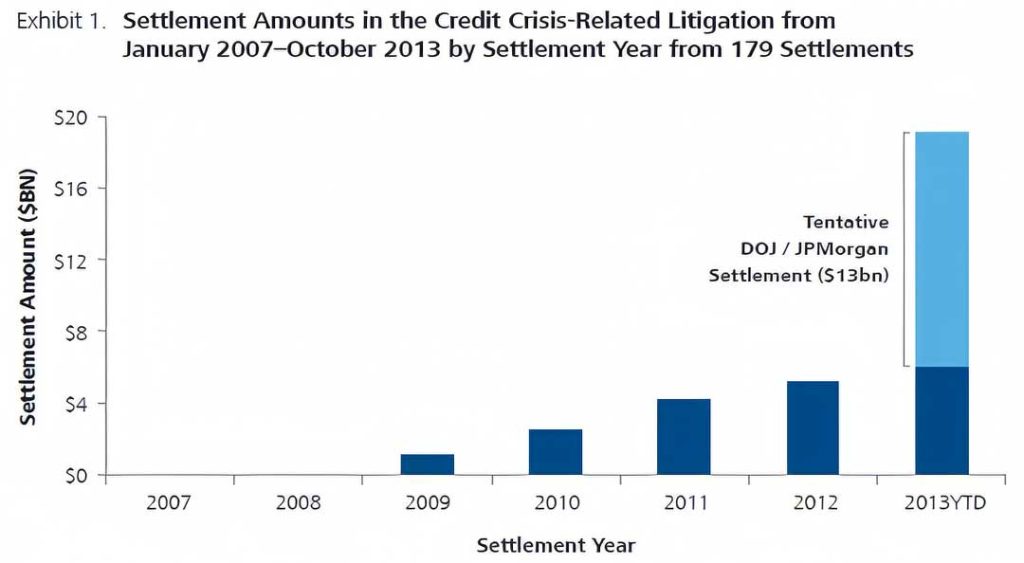

While new filings have declined, settlement activity is on the rise in 2013, and according to Sabry, Wang, and Mani these settlement amounts are trending larger, even absent the record $13 billion regulatory settlement against JB Morgan.

In addition to the settlements described above, Fannie Mae and Freddie Mac have recovered more than $18 billion from several financial institutions to resolve mortgage repurchase claims. The large settlement total is not surprising, however, as Sabry, Wang, and Mani note that in 2011, 2012, and 2013, the majority of financial lawsuits filed involved ABS and MBS.

Breach of contract cases have surged in the past two years, while 10b-5, ERISA, and other claims have declined, perhaps signaling a new wave of financial crisis related litigation.

As cases filed early on following the credit crisis age, it is not surprising that settlement activity is up. The authors of the study warn that though new filings are down, the size and scope of financial crisis related cases are on the rise. They also warn that there could be follow-on litigation arising from recent large regulatory settlements against banks and other large financial institutions. In short, financial crisis litigation is far from over.