by David Schwartz J.D. CPA | Apr 27, 2016 | All, Change Overview and Rationale

On April 13, 2016, the Office of Financial Research (OFR) published its annual systemic importance data for the world’s larges banks. Based on data released in 2013 and 2014 by the Basel Committee, the OFR’s report examined data for the global 30 banks designated as...

by David Schwartz J.D. CPA | Mar 23, 2016 | All, Change Overview and Rationale, Formal Regulatory Remedies

The Basel Committee on Banking Supervision today released a consultative document proposing a set of changes to the Basel III framework’s approaches for determining Banks’ regulatory capital requirements for credit risk. The goals of these changes are to (i)...

by David Schwartz J.D. CPA | Oct 19, 2015 | All, Change Overview and Rationale, Formal Regulatory Remedies

The Fed, Financial Stability Board, and the Bank for International Settlements have beein quite busy this summer, and each issued rules or consultations in July furthering Basel III initiatives. On July 1, the Basel Committee issued a consultative document on its...

by David Schwartz J.D. CPA | Dec 20, 2014 | All, Change Overview and Rationale, Cross-Post, Formal Regulatory Remedies

Borrower default indemnification, sometimes referred to as a “securities replacement guarantee,” is fairly common in the securities lending industry. Under the typical arrangement, should a borrower of a security fail to return it at the end of the loan, the...

by David Schwartz J.D. CPA | Dec 19, 2014 | All, Change Overview and Rationale, Formal Regulatory Remedies

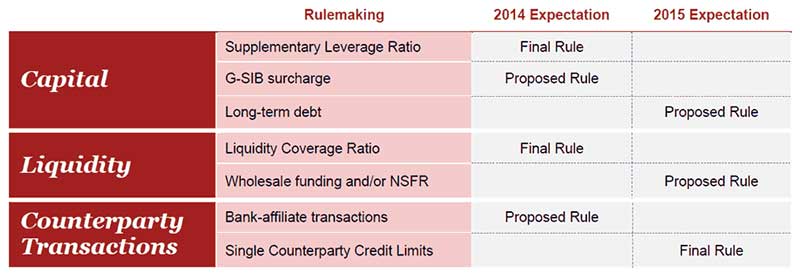

With the Dodd-Frank Wall Street Reform and Consumer Protection Act having just celebrated its fourth birthday, where exactly are we in the the reform of our seemingly ever-evolving regulatory framework? In a recent paper, Dan Ryan, Chairman of the Financial Services...