The Securities and Exchange Commission (SEC) filed a civil lawsuit against Archegos Capital Management, its founder, and several other individuals in April 2022. The SEC alleges that Archegos engaged in a fraudulent scheme to manipulate the market for the securities of the issuers that represented Archegos's top 10 holdings, both through purchases of the issuers' securities and entry into total return swaps referencing those issuers. This event has led investment firms on both the buy and sell sides to reconsider how they manage counterparty and market risks and how they will structure their future securities financing and liquidity management strategies.

The SEC's complaint alleges that Archegos used total return swaps to make large bets on the stock prices of several companies, including ViacomCBS, Discovery, and Tencent.[1] These bets were highly concentrated, meaning that Archegos was exposed to significant losses if the stock prices of these companies declined. The complaint also alleges Archegos made false and misleading statements to its counterparties to induce them to enter these swaps. For example, Archegos falsely represented that it had a diversified portfolio of investments when, in reality, it was highly concentrated in a few stocks.

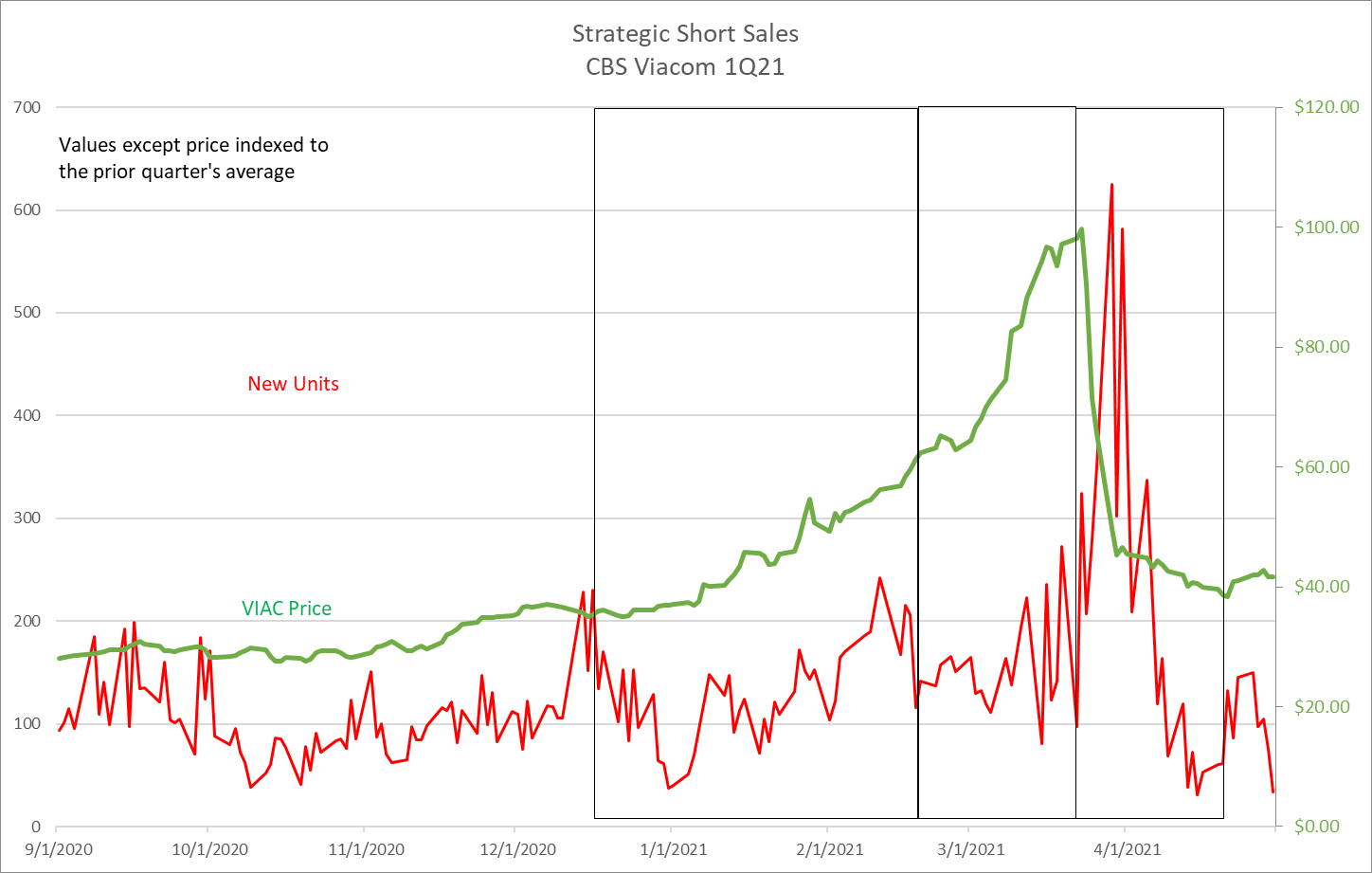

At its peak, Archegos traded as much as 50% of the issued and outstanding float each day in its target issues. The trading patterns of Archegos’ traders, according to the SEC, changed from the small trades of an arbitrage house to the massive directional blocks of a “brazen” manipulator of illiquid stocks. As the stock prices inflated, so did the swap portfolio’s leverage as Archegos leveraged its excess collateral to the maximum. However, the hedging strategies of its swap counterparties’ and market makers’ Delta One desks could be seen in the securities funding markets. Short sellers were drawn to the trade en masse, as evidenced by the rapid growth of new ViacomCBS securities loans.

The fund, organized as a registered family office, had no regulatory obligation to report its aggregate exposures, number of lenders, or swap positions. As a result, each counterparty could only see Archegos's activity with their own company, particularly prime brokers, who were only aware of the credit their own firms were providing.[2]

In March 2021, the stock prices of Archegos's top 10 holdings began to decline. This triggered margin calls from Archegos's counterparties, who demanded that Archegos post more collateral to support its positions. Archegos was unable to meet these margin calls and defaulted on its obligations. This led to a fire sale of Archegos's positions, which caused billions of dollars in losses for its counterparties, including several of the top Wall Street investment banks.

The Archegos scandal raised new concerns about the risks posed by highly concentrated positions in the financial markets. The scandal exposed the vulnerability of counterparties, even the top investment banks, to the inadequacy of existing disclosures. Furthermore, reporting lags can easily result in misinterpretations of the relationship between short selling and leveraged securities borrowing activity, making it difficult for securities servicing agents to use existing data sets to manage their counterparty credit risks.

At best, beneficial owners, borrowers, and their intermediaries only have access to siloed slivers of the larger market for securities lending. And because reporting is often at the omnibus account level, even securities finance data vendors lack the market-wide transaction-level data necessary to help their clients detect and avoid the next Archegos. Even the SEC’s securities lending transaction reporting proposal may not have provided the granular transaction data necessary to prevent another Archegos event.[3]

The Federal Reserve's postmortem on the failure of Archegos highlights two lessons for market participants:

- Firms should ensure that their margining procedures follow best practices, including avoiding inflexible and risk-insensitive margin terms or extended close-out periods.

- Firms should better understand and monitor a counterparty's aggregate portfolio composition, concentration, and exposures to other firms.[4]

In conclusion, as noted by the Bank of England, the Archegos episode illustrates that “specials lending entails concentrated, idiosyncratic risk that needs to be managed, and lenders should be mindful of appropriate haircut levels when faced with the prospect of stressed markets across different jurisdictions.”[5]

[1] The SEC's complaint alleges that Archegos's fraudulent scheme violated the securities laws' antifraud provisions. The SEC is seeking injunctive relief, disgorgement of profits, and civil penalties. Bill Hwang has pleaded not guilty to the criminal charges filed against him by the Department of Justice. The civil case is still pending.

[2] Although transaction reporting is now required in the US, at the time total return swaps contracts used by Archegos to obtain leveraged exposure to certain equities were not subject to these requirements Since November 8, 2021, security-based swaps in the US have been required to be reported to security-based swap trade repositories. Public dissemination of transaction information has been required since February 2022.

[3] Reporting of Securities Loans, Rel. No. 34-93613, File no. S7-18-21, 86 FR 69802-69853, (Dec. 8, 2021)