Visits to the Federal Reserve, Treasury Department, and FINRA

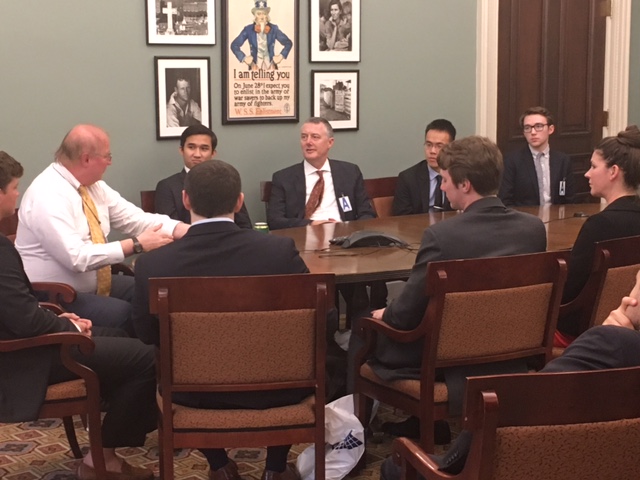

2016 ROSE Program scholars discuss policy issues with officials at the Federal Reserve in Washington, DC.

In addition to the comment letter competition, the teams of Fordham students were invited to visit the Board of Governors of the Federal Reserve Bank in Washington, DC.

At the April 27, 2016 meeting, the winning team presented its paper and findings to Fed officials. The teams of Fordham scholars also had the opportunity to discuss a wide range of issues related to economic policy and regulation.

ROSE Program students at the Treasury Department with Mark J. Mazur, Assistant Treasury Secretary for Tax Policy, in Washington, DC, April 27, 2016

In addition to a visit to the Fed, the ROSE Program participants were invited to the Treasury Department and met with Mark J. Mazur, Assistant Treasury Secretary for Tax Policy, who described the operations of the Treasury and discussed a wide range of regulaory issues with the Fordham scholars, including

tax Inversions and corporate tax rates in general, transaction taxes, a more progressive tax system, a simpler tax system, and the "Panama List".

ROSE scholars discussing a variety of regulatory matters with FINRA officials, April 27, 2016. (from right to left) Brant Brown, Associate General Counsel, Office of the General Counsel; Phillip Shaikun, Associate General Counsel, Office of the General Counsel; Gerri Walsh, President, FINRA Foundation and Senior Vice President, Investor Education; and Richard Vagnoni, Senior Economist, Office of Emerging Regulatory Issues

Officials at the Financial Industry Regulatory Authority (FINRA) graciously invited the ROSE scholars to visit them at their offices where a panel of senior FINRA officials discussed how the broker-dealer community is self-regulated, as well as how FINRA coordinates with the SEC. In addition, the panel shared their perspectives on electronic trading, exchanges, and the challenges of independent (i.e., non-governmental) self-funding regulators.

CSFME submitted a comment letter of its own supporting generally the goals of the Basel Committee to minimize the potential systemic implications resulting from situations where banks may choose to provide financial support during periods of financial stress to entities beyond or in the absence of any contractual obligations. The Center expressed some concerns and offered some suggestions, however, regarding the approach taken by the Consultation. Furthermore, by offering an example from the trade finance sector, the Center suppprted its belief that the nature of step-in risk may be one example of an acceptable, non-diversifiable exposure, given the potential positives for the economy at large.