Widespread adoption of central bank digital currencies (CBDC) could revolutionize cross-border payments by reducing friction and making it possible for T+1 or even T+0 settlement of cross-border trades. The Fed’s Digital Currency discussion paper is the central bank’s first step in a public discussion with stakeholders about a digital dollar, as we described in our January 25 post. But what would such a cross-border payment system look like? Is it enough to mimic the traditional systems of SWIFT, DTCC, and others? Or does the unprecedented interoperability and technology of CBDCs force obsolesce on the current systems?

With some countries, most notably China, having already adopted digital versions of their national currencies and many more sovereignties in catch-up mode, the Bank for International Settlements (BIS) and the World Bank have started envisioning what cross-border transactions would look like in a CBDC world. They theorize potential CBDC systems for cross-border payments could take several forms. Each of these could reduce many aspects of the friction and inefficiencies inherent in current cross-border payment systems through fewer intermediaries, better integration and technical compatibility, and mitigation of cross-border and cross-currency risks.1

What are the Cross-border CBDC Models Being Considered?

In a pair of reports2, the World Bank and BIS jointly posit three different models for integrating CBDCs into cross-border payment systems.

-

Compatible CBDC Systems Model - Setting common international standards would permit the interoperability of separate CBDC systems.3 This model resembles traditional cross-border payment arrangements. Common technical standards, such as message formats, cryptographic techniques, data requirements, and user interfaces can reduce the operational burden on financial institutions for participating in multiple systems.

Source: Report To The G20: Central Bank Digital Currencies For Cross-Border Payments

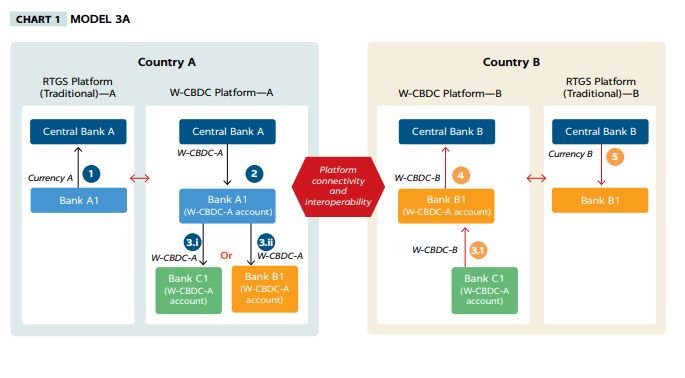

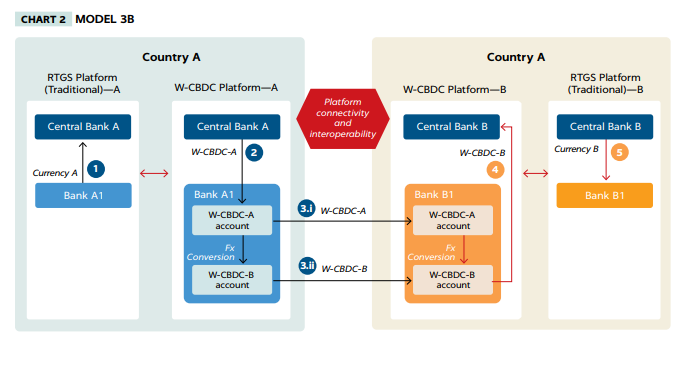

- Interlinked CBDC Systems Model - A shared technical interface, supported by contractual agreements between the systems, allows participants – either retail or wholesale – in one system to make payments to those in another. A common clearing mechanism takes a different approach by linking systems through designated settlement accounts.

Source: Report To The G20: Central Bank Digital Currencies For Cross-Border Payments

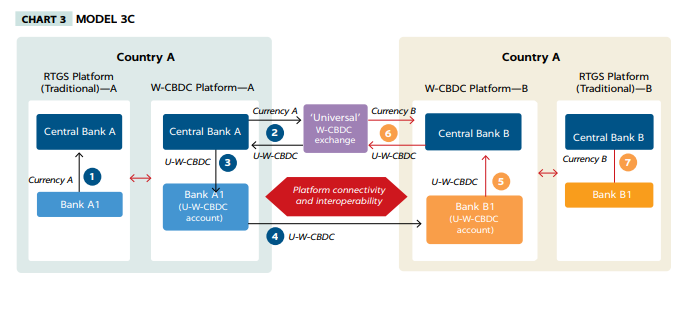

- Single system for multi-central bank digital currency multi-CBDC - This model posits a single CBDC system across jurisdictions. The concept builds on having a single set of rules, a single technical system, and a single set of participants. It implies cooperation of a higher magnitude among central banks. This deeper integration allows for potentially more operational functionality and efficiency but increases the governance and control hurdles.

Source: Report To The G20: Central Bank Digital Currencies For Cross-Border Payments

Each of these models has its own strengths and weaknesses. But all of them rely on strong interoperability, which could, in turn, introduce a whole host of security, privacy, and anti-money-laundering challenges. These challenges are not new or insurmountable, just different, according to Thomas Zschach, SWIFT’s Chief Innovation Officer,

“Making payments infrastructure based on CBDCs efficient and interoperable with the broader economy presents some new challenges, but the majority are the same as those faced by existing payment solutions.”

4

The overarching difficulty, however, lies in adapting existing practices and payment mechanics to digital currency technologies, and vice versa.

Who Is Testing these Models? Is there a Proof of Concept?

Project Helvetia at the Bank for International Settlements

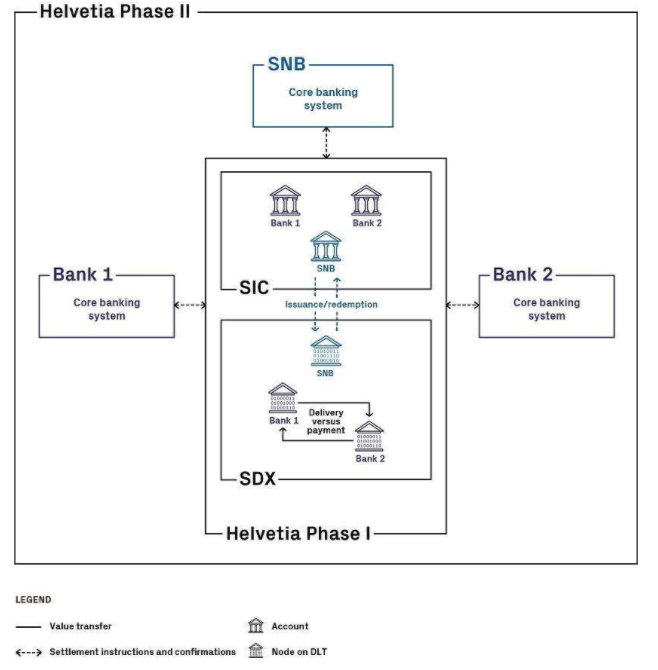

The Bank for International Settlements’ (BIS) Innovation Hub has already launched a two-part proof of concept of the use of a wholesale central bank digital currency5 called, “Project Helvetia.” The experiment was intended to investigate ̈experiment investigates how the provision of central bank money for wholesale settlement might be adapted if distributed ledger technology (DLT) and tokenization are adopted by financial markets." According to BIS:

“Project Helvetia investigates how central bank money can be used for settlement in a world where securities and other financial assets migrate from today’s centralised financial market infrastructures to new so-called decentralised or tokenised platforms for trading and post-trading activities. One proof of concept relies on wholesale central bank digital currency (w-CBDC) whereas another is based on a link to the existing central bank system for wholesale payments.”

-

Phase I built on the test environments of the Swiss real-time gross settlement system – SIX Interbank Clearing (SIC) system6 – and SIX Digital Exchange (SDX), a platform for the trading and settlement of tokenized assets, assets that exist on a DLT platform, settled with a privately issued digital coin.

-

Phase II expanded on the work carried out in Phase I by (i) adding commercial banks to the experiment; and (ii) integrating wholesale central bank digital currency (wCBDC) into the core banking systems of the central bank and commercial banks. It demonstrated that a wholesale central bank digital currency (w-CBDC) can be integrated with existing core banking systems and processes of commercial and central banks. Furthermore, it showed that issuing a wCBDC on a DLT platform operated and owned by a private sector company is feasible under Swiss law.7

Source: https://www.bis.org/publ/othp45.pdf

Phase I of Project Helvetia, concluded in December 2020, demonstrated the functional feasibility and legal robustness of settling tokenized assets with a wholesale central bank digital currency and with linking a DLT platform to the existing central bank payment system. Phase II tested the integration of wholesale CBDC settlement with the core banking systems of five commercial banks. Among its findings, Phase II, completed in January 2022, concluded that cross-border transactions employing CBDCs could be made in a few seconds, instead of the three to five days necessary using the current system.8

The speed was achieved by eliminating some of the frictions of the current system, including the mechanics of currency exchange, variations in different technological infrastructure, timezone complications, and coordination problems among intermediaries, including correspondent banks and nonbank financial service providers.

Project Jura at Bank of France and Swiss National Bank

Project Jura, a joint project of the BIS Innovation Hub, the Bank of France, the Swiss National Bank, and a private sector consortium9, continued the work of Helvetia and explored the settlement of tokenized euro commercial paper and foreign exchange transactions. Tests run and concluded in December 2021 were conducted in a sandboxed, near real-life setting. Jura studied a new approach for central banks to allow access to CBDC’s for Swiss-regulated non-resident financial institutions.10

According to BIS, Project Jura was intended to test as-yet unexplored aspects of cross-border CBDC mechanics:

“Issuing wholesale CBDCs on a third-party platform and giving regulated non-resident financial institutions direct access to central bank money raises intricate policy issues. Jura explored a new approach including subnetworks and dual-notary signing, which may give central banks comfort to issue wholesale CBDCs on third-party platforms and to provide regulated non-resident financial institutions with access to wholesale CBDCs.”

Other Cross-border Studies

The BIS Innovation Hub is participating in two other trials exploring the use of a wholesale CBDC for cross-border payments, referred to as a multi-CBDC (mCBDC). One is mCBDC Bridge, a project between the central banks of Thailand, Hong Kong, China, and the UAE. Another is Project Dunbar, in which the Monetary Authority of Singapore is trialing a single DLT solution where banks can use multiple CBDCs for cross-border payments.

Conclusion

The frontier of cross-border CBDC transactions lies before us. The results of various projects spearheaded by BIS, central banks, and national monetary authorities demonstrate that a faster, more efficient, and less costly cross-border payment system is possible. As Sopnendu Mohanty of the Monetary Authority of Singapore (MAS) said,

“That’s where the beauty of a wholesale (CBDC) currency plus a DLT based shared ledger could make a big difference, . . . collectively bring[ing] down the 3% cost to a sub dollar cost for transfers and hence encourage financial inclusion.”

1 Bank for International Settlements, “Report To The G20: Central Bank Digital Currencies For Cross-Border Payments,” July 2021

2 World Bank Group, "Central Bank Digital Currencies for Cross-border Payments: A Review of Current Experiments and Ideas," Nov. 2021; Bank for International Settlements, “Report To The G20: Central Bank Digital Currencies For Cross-Border Payments,” July 2021,

3 SWIFT’s ISO 20022 is an emerging global open standard for payments messaging that could be adapted to accommodate the eventual widespread adoption of CBDC’s for cross-border payments. https://www.swift.com/standards/iso-20022

4 https://www.swift.com/news-events/news/exploring-central-bank-digital-currencies-swift-and-accenture-publish-joint-paper

5 Wholesale CBDCs are for use by regulated financial institutions, in contrast to retail CBDCś that would be used by the public. https://www.bis.org/publ/arpdf/ar2021e3.htm

6 RealTime Gross Settlement (RTGS) is a system where there is the continuous and real-time settlement of fund-transfers, individually on a transaction by transaction basis (without netting). 'Real Time' means the processing of instructions at the time they are received. Because the funds settlement takes place in the books of a nation’s central bank, the payments are final and irrevocable. https://www.bankofengland.co.uk/-/media/boe/files/payments/rtgs-chaps-brief-intro.pdf

7 https://www.bis.org/about/bisih/topics/cbdc/helvetia.htm

8 https://www.snb.ch/en/mmr/reference/project_helvetia_phase_II_report/source/project_helvetia_phase_II_report.en.pdf

9 Accenture, Credit Suisse, Natixis, R3, SIX Digital Exchange, and UBS

10 https://www.bis.org/press/p211208.htm